24 Tax Tax for individual. Go through the instructions carefully.

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

The following entities and accounting firms in Malaysia must file their taxes.

. If paid up capital is less than RM 25 million 1st RM ½ million. To check whether an Income Tax Number has already been issued to you click on Semak No. This translates to roughly RM2833 per month after EPF deductions or about RM3000 in net income.

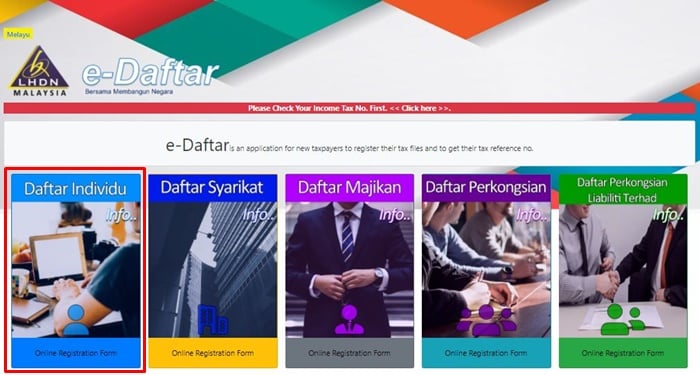

Taxable income is now extracted from gross income which is 219000. They can be registered with the Suruhanjaya Syarikat Malaysia SSM whether as a sole proprietor or partnership business as doing so will entitle you to some tax incentives that are inaccessible to taxpayers with non-business income. Register Online Through e-Daftar.

Click on e-Daftar. In the textbox labeled Enter your User. Copy of Form D The Certificate of Registration from CCM.

Any individual earning a minimum of RM34000 after EPF deductions must register a tax file. Where a company commenced operations. Fill up PIN Number and MyKad Number click Submit button.

Click on the e-Daftar icon or link. Click on ezHASiL. Companies limited liability partnerships trust bodies and cooperative societies which are dormant andor have not commenced business are required to register and furnish Form E with effect from Year of Assessment.

As the taxable value is between 15 to 25 lakhs so that 5 will apply to income. Amending the Income Tax Return Form. A copy of international passport Non-Resident Business Registration Certificate individuals with businesses.

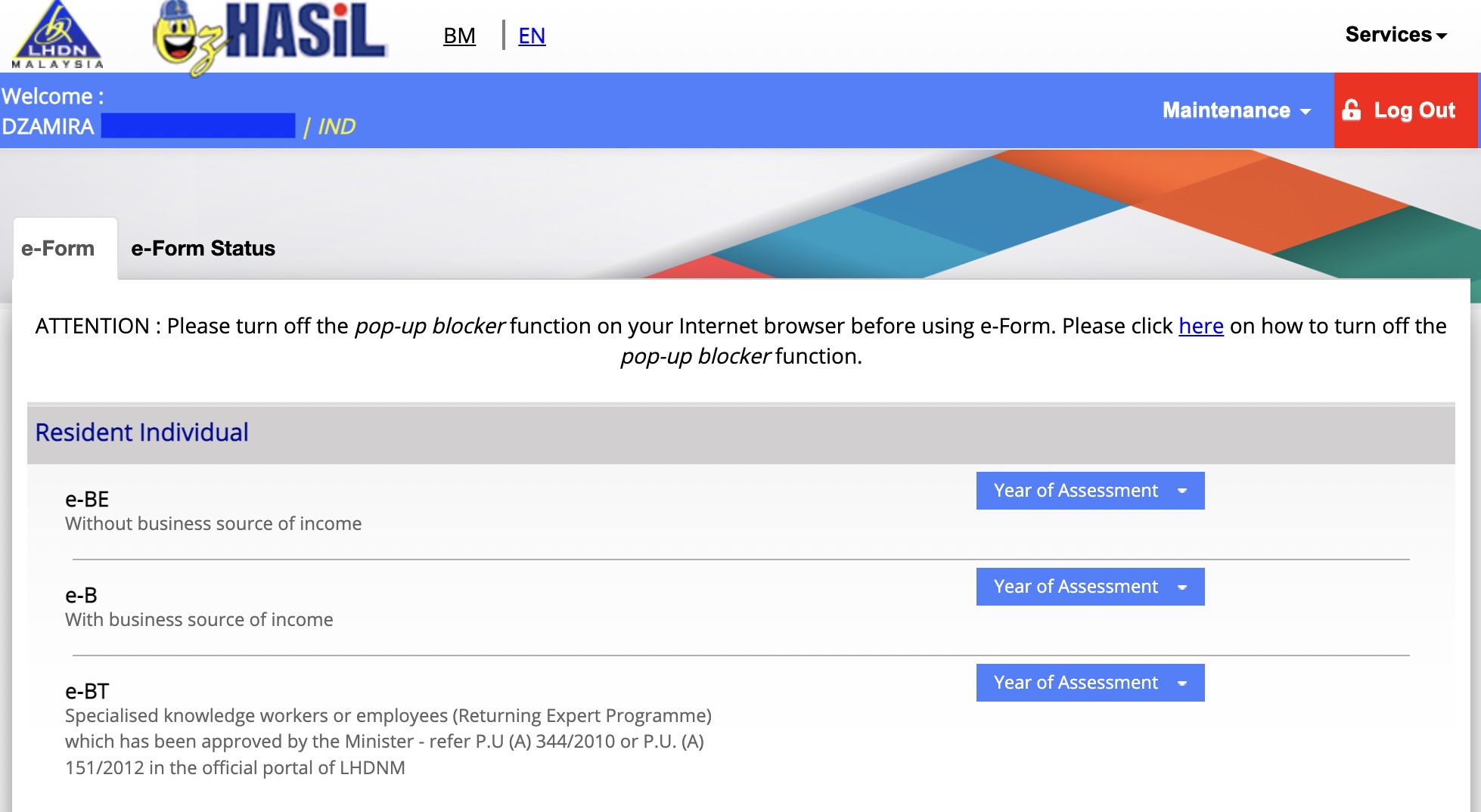

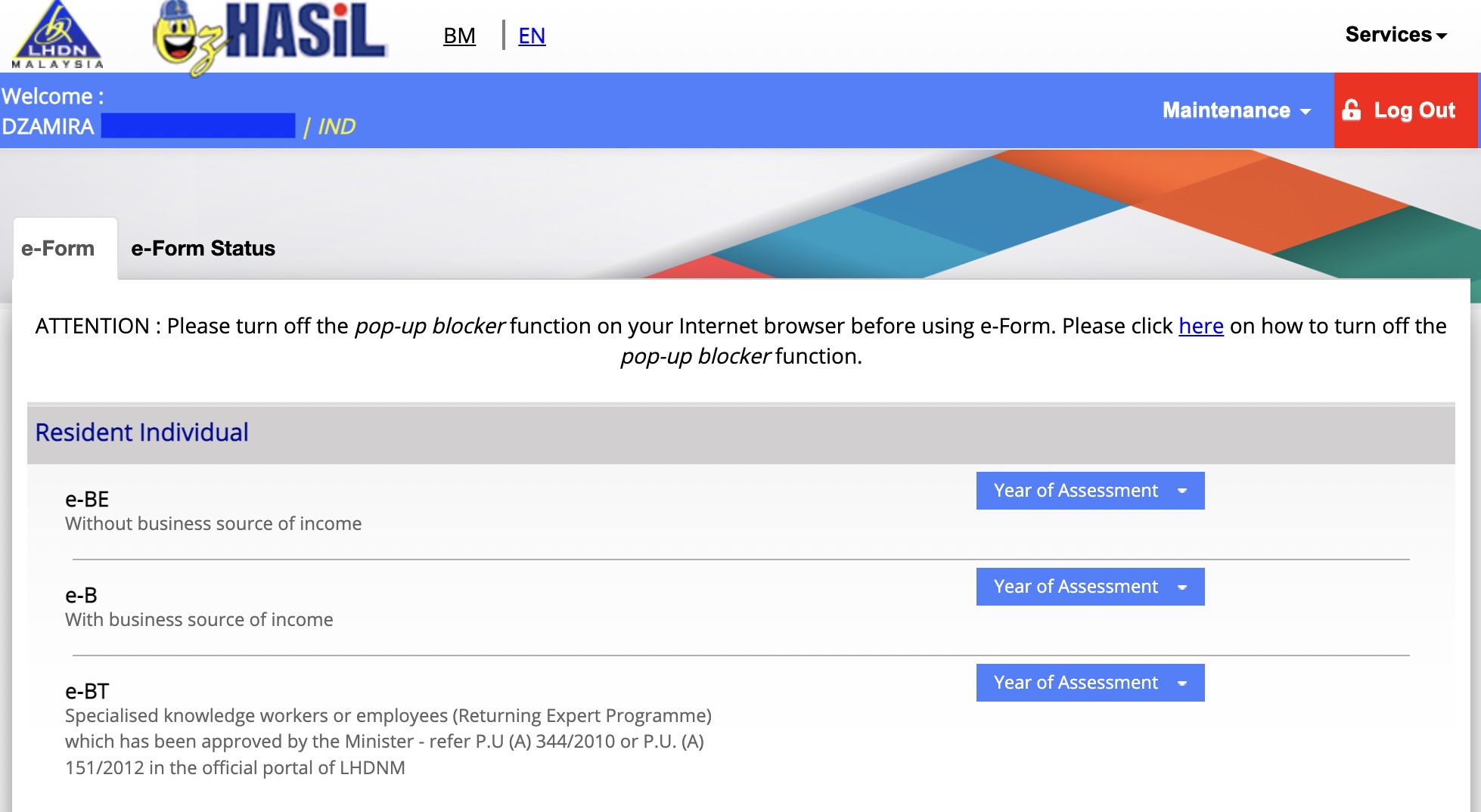

Lets take a look at the registration steps. Click on e-Filing PIN Number Application on the left and then click on Form CP55D. A step-by-step guide to the Malaysia Income Tax online submission for the calendar year of 2020 via LHDN e-filing.

This is with the exception of those who carry out partnership businesses in Malaysia. Use e-Daftar and register as a taxpayer online. Browse to ezHASiL e-Filing website and click First Time Login.

Copy of Form A Business Information from CCM or. An employee who is subject to monthly tax deduction. To kickstart the process of registering as a taxpayer head on over to the LHDNs e-Daftar website where you can conveniently carry out the process onlineYoull need to upload a digital copy of your IC to serve as supporting document so it would be a good idea to prepare that beforehand.

Fill in the required details and attach your Form CP55D. Resident individual with employment income and does not carry on business. To file your income tax the expatriate will need to obtain a tax number from the Inland Revenue Board of Malaysia IRB.

Examples of side businesses are plenty including online stores on e-commerce platforms blogging. It should be noted that this takes. Individual who has income which is taxable.

Click on the borang pendaftaran online link. 19 TaxOther balance. Copy of a letter from the Bar Council.

Once you do this your e-Filing account digital certificate will be registered may proceed to complete the ITRF through ezHASiL e-Filing. You must be wondering how to start filing income tax for the. Copy of an acknowledgement letter from Malaysia Institute of Accountants MIA or.

With this affected individuals can continue to enjoy the exemption from 1 January 2022 to 31 December 2026. It takes just four steps to complete your income tax number registration. Go back to the previous page and click on Next.

Resident individual who carry on business with employment and other income. Special Income Remittance Program PKPP For Malaysian Tax Resident With Foreign Sourced. They will be subject to tax for any foreign-sourced income received in Malaysia effective from 1 January 2022.

How to File Income Tax in Malaysia 2022 LHDNAre you filing your income tax for the first time. However if the company has failed to obtain one the worker can register for an income tax number at the nearest IRB office. Unregistered companies with IRBM.

Normally companies will obtain the income tax numbers for their foreign workers. Read Also The sales and service tax SST in Malaysia. They need to apply for registration of a tax file.

Non-resident individual who carry on business with employment income or others The residency status of individuals is subject to Section 7 Income Tax Act 1967. Online e-Daftar which is accessible from MyTax httpsmytaxhasilgovmy Required supporting documentation are. A business or company which has employees and fulfilling the criteria of registering employer tax.

Click on Permohonan or Application depending on your chosen language. At the IRB office ask for the form to register a tax file. In other words you need to pay income tax if youve been earning a minimum net salary of RM3000 per month or RM2833 per month after EPF deductions for an entire year.

Review all the information click Agree Submit button. All types of income are taxable in Malaysia. Submit the form along with a copy of your identification MyKad or other IDs and your salary details EAEC Of course you can also register using the tax offices online portal e-Daftar.

Visit the official Inland Revenue Board of Malaysia website. How to register. According to the Lembaga Hasil Dalam Negeri LHDN any individual earning a minimum of RM34000 for the financial year after EPF deductions must register a tax file.

Deadline for Malaysia Income Tax Submission in 2022 for 2021 calendar year Personal Tax Relief 2021. Taxable income is on which we apply the tax Tax is 5 on income below 250000. Write the formula B2-B3-B4 inside the formula bar and press the Enter key.

Company Tax Deduction 2021. Fill up this form with your employment details. You need to pay tax If your income is over RM 34000 per year Individual tax rate is 28.

A businessperson with taxable income. Access the official Income Tax Department Portal by going to the URL httpswwwincometax govin and clicking on the Login Here link on the homepage of the website. Copy of an appointment letter as a tax agent for if the registration is done by a tax agent and.

How To File Your Taxes For The First Time

How To File Your Taxes For The First Time

Filing Your Taxes For The First Time In Malaysia Read This First Ya 2021 Althr Blog

How To File Your Taxes For The First Time

Individual Income Tax In Malaysia For Expatriates

How To Step By Step Income Tax E Filing Guide Imoney

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

The Complete Income Tax Guide 2022

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

How To File Your Taxes For The First Time

How To File Your Taxes For The First Time

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Malaysia Personal Income Tax Guide 2022 Ya 2021

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

How To Register As A Taxpayer For The First Time In 2022

Personal Income Tax E Filing For First Timers In Malaysia Mypf My